Understanding SoFi StockTwits: A Deep Dive into Market Sentiment

Understanding SoFi and StockTwits

SoFi StockTwits, or Social Finance, Inc., is a personal finance company based in the United States, established with a mission to help individuals achieve financial independence. Launched in 2011, SoFi initially focused on student loan refinancing but has since expanded its offerings to include personal loans, mortgages, investment management, and insurance. This diverse range of financial services caters to the needs of a wide array of clients, from students to seasoned investors, facilitating greater access to various financial opportunities.

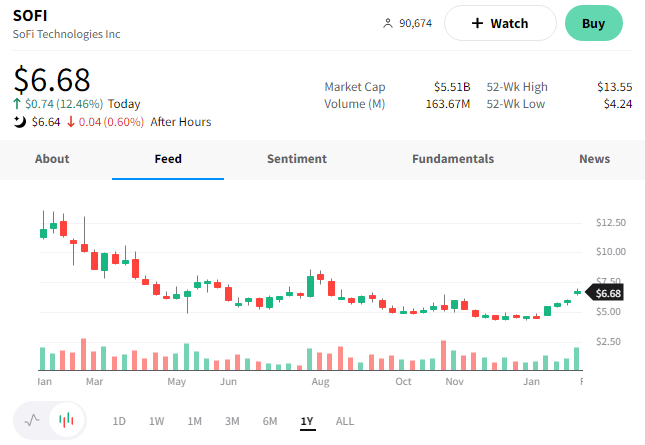

In recent years, SoFi has gained attention in the financial markets, particularly after its IPO in June 2021. The company went public through a merger with a special purpose acquisition company (SPAC), becoming a focal point for retail investors. Historical stock performance has showcased volatility, which, paired with innovative services, has captured the interest of those tracking SoFi stock on platforms like StockTwits. This social media platform allows users to share their insights and sentiments regarding SoFi and other stocks, making it a valuable resource for gauging market opinion.

StockTwits serves as a leading social media platform specifically for investors, enabling them to discuss stocks in real time. The platform facilitates the exchange of ideas and sentiment on various financial assets, including popular stocks like SoFi. Users can leverage StockTwits to analyze the collective sentiment surrounding a stock, portfolio strategies, or investment tips. This ecosystem supports a dynamic conversation, contributing to stock price movements and aiding investors in making informed decisions. As we explore the relevance of SoFi within the financial sector and the interplay with platforms like StockTwits, we’ll uncover how these elements shape investor behavior and market trends.

The Popularity of SoFi on StockTwits

SoFi, or Social Finance Inc., has gained substantial traction among investors and traders on StockTwits, a social media platform designed for sharing ideas and sentiments regarding stocks. The popularity of SoFi on StockTwits can be attributed to several factors, including user engagement, key conversations, and trending discussions. As of October 2023, the discussions surrounding SoFi stock have illustrated a vibrant community enthusiastic about the company’s prospects.

A major factor contributing to the popularity of SoFi stock on StockTwits is the platform’s user demographic. Many of the platform’s active users are retail investors seeking to share insights and gauge market sentiment in real-time. The accessibility and immediacy of StockTwits enable users to react quickly to news releases, earnings reports, and other market-related events, which are particularly impactful for SoFi given its status as a relatively young financial technology firm. When notable events or announcements, such as partnerships, product launches, or changes in leadership, occur, discussions around SoFi can spike dramatically, bringing in fresh sentiment and interest.

Another aspect fueling conversations is the topical relevance of SoFi’s offerings. The company’s innovative suite of financial products, including personal loans, mortgage services, and investment options, resonates well with the consumer base discussing their financial strategies and investment goals on StockTwits. The advent of neo-banking and the emphasis on a digital-first approach to finance have injected positivity and excitement into the discussions surrounding SoFi stock.

Furthermore, key influencers and prominent figures within the investment community often reference SoFi on StockTwits, amplifying discussions and attracting more followers. Their insights and analyses contribute to a higher level of engagement and attract investors interested in both the stock and the underlying company narrative. Consequently, SoFi’s popularity on StockTwits continues to grow, making it a focal point of sentiment analysis for market observers and individual traders alike.

Analyzing Sentiment Trends: Bullish vs Bearish on SoFi

The sentiment surrounding SoFi Technologies, Inc. (Nasdaq: SOFI) on StockTwits reflects the diverse opinions of investors and traders alike. Understanding these sentiments is crucial for grasping market dynamics, as they can provide insights into potential future price movements. By dissecting both bullish and bearish sentiments, we can better understand the underlying factors that drive market perspectives.

Tracking sentiment analysis over time reveals fluctuating investor confidence in SoFi’s growth trajectory. Bullish sentiment is often fueled by favorable developments, such as positive earnings reports, product expansions, or successful partnerships. For instance, when SoFi announced new features within its platform aimed at enhancing user experience, the response on StockTwits was predominantly positive, leading to a spike in bullish sentiment. In such instances, investors express optimism, expecting the stock to appreciate as the company’s fundamentals strengthen.

Conversely, bearish sentiment generally arises from negative news or market conditions. Factors such as regulatory challenges, increased competition, or economic downturns can prompt StockTwits users to express skepticism regarding SoFi’s future performance. For example, during periods of market volatility, concerns about SoFi’s exposure to macroeconomic risks have led to a rise in bearish commentary. This shift in sentiment reflects a cautious approach from investors who may anticipate price declines in the face of potential challenges.

To visualize these trends, sentiment scores calculated from StockTwits data can illustrate the balance of bullish versus bearish perspectives. Analyzing these scores over a defined timeframe provides a clearer picture of how market sentiment shifts in response to new developments. Understanding these intricate dynamics can greatly assist investors in making informed decisions regarding their SoFi stock holdings.

Key Influencers and Analysts Discussing SoFi on StockTwits

In the realm of social media-driven stock conversations, StockTwits has become a pivotal platform for investors to share insights and analyses about various equities, including SoFi Technologies, Inc. Several influential figures and analysts have emerged within this space, providing valuable perspectives on SoFi stock through their research and predictions. Understanding their backgrounds and the feedback they provide is essential for gauging market sentiment surrounding SoFi.

One notable influencer on StockTwits is Chris N. He is well-regarded for his analytical prowess and keen understanding of technology stocks. With a background in financial analysis and a degree from a reputable university, Chris has amassed a significant following on StockTwits. His insights often include detailed technical analyses of SoFi stock, focusing on market trends and trading patterns. Followers frequently cite his predictions due to their historical accuracy, which lends credibility to his observations concerning SoFi’s performance.

Another key figure is Mary T, a financial journalist specializing in fintech investment. With over a decade of experience in the industry, she provides comprehensive analyses of SoFi’s business model and performance metrics. Mary often focuses on macroeconomic factors affecting fintech stocks, sharing her opinions on how these variables could impact SoFi stock prices. Her followers appreciate her in-depth approach, making her posts a popular source of information on StockTwits.

Furthermore, analysts from financial institutions also contribute to the discussion, providing institutional insights into SoFi’s potential growth and challenges. These analysts often have extensive, data-driven backgrounds, which add a layer of credibility to their analyses. In turn, their insights can heavily influence the sentiment on StockTwits, shaping how retail investors perceive SoFi stock.

As the SoFi narrative evolves on StockTwits, closely following these influential figures and analysts can provide invaluable context for investors looking to make informed decisions based on shared market sentiment.

User-Generated Insights: Top Posts on SoFi StockTwits

StockTwits has emerged as a pivotal platform for investors seeking real-time insights and community-driven analysis regarding equity stocks such as SoFi. The user-generated posts on SoFi StockTwits reflect a multitude of opinions that encapsulate current market sentiments, trading strategies, and predictions about the company’s future performance. This vibrant community fosters a unique environment where traders share their thoughts, encouraging dialogue and collective analysis.

One notable post highlighted by users expressed optimism about SoFi’s recent expansion into new financial services, suggesting that this could lead to significant growth in user acquisition. Comments on this post emphasized the potential for increased market penetration, reflecting bullish sentiment amongst some investors. Coupled with this positive outlook, discussions revealed concerns regarding general market volatility and its possible impact on SoFi’s stock price, underscoring the nuanced views among the community.

Another impactful conversation featured a series of analyses related to SoFi’s earnings reports. Users were particularly interested in the performance metrics and future guidance provided by the company. This dialogue provided valuable insights for traders considering short-term strategies versus long-term investments in SoFi stock. One user noted that the current valuation presents a buying opportunity, while others pointed out the importance of assessing macroeconomic factors that could affect stock performance.

Additionally, a range of posts examined potential risks associated with investing in SoFi, including regulatory challenges that may impede growth. The diversity of opinions surrounding the anticipated IPO of rival fintech companies also sparked debate among users assessing SoFi’s competitive position in the evolving market landscape.

In summary, the discussions on SoFi StockTwits provide a dynamic snapshot of user sentiment, reflecting both optimism and caution. By analyzing these contributions, investors can gain a more comprehensive understanding of the broader market perspective surrounding SoFi, aiding them in making informed investment decisions.

Comparative Analysis: SoFi Vs. Competitors on StockTwits

The presence and performance of SoFi on StockTwits offer a unique perspective on market sentiment within the finance and lending sector. When analyzed in comparison to its competitors, SoFi reveals significant insights into investor engagement and overall discourse. Key competitors such as Upstart, LendingClub, and Affirm also maintain profiles on StockTwits, each contributing to the narrative in distinct ways.

Investor sentiment surrounding SoFi often reflects a combination of optimism and caution. The company’s innovative offerings, such as personal loans, investment options, and student refinancing, are frequently discussed among users who highlight the potential for growth. In contrast, investment chatter regarding competitors like Upstart tends to focus more on its AI-driven loan approval process, which some investors view favorably for its disruptive potential. This divergence in focus indicates a differentiated brand image and investor perception among these firms.

Engagement levels also vary markedly between SoFi and its rivals on StockTwits. Discussions about SoFi often result in an increased volume of messages, which signifies a more active community. This heightened engagement may stem from strong promotional strategies and a loyal customer base that actively shares their investment experiences. On the other hand, while companies like LendingClub maintain engagement, conversations may not be as frequent or fervent compared to those surrounding SoFi, reflecting varying levels of community support and investor enthusiasm.

Overall discourse on StockTwits characterizes the competitive landscape for SoFi, as it navigates its market position. Investors often express nuanced views on growth potential, competitive advantages, and the broader economic context. Analyzing these differing sentiments among SoFi and its competitors on StockTwits is essential for understanding the driving forces behind stock performance and investor behavior in this sector.

The Impact of External News and Events on SoFi StockTwits

In today’s rapidly evolving financial landscape, external news and events greatly influence stock market sentiments, including discussions surrounding SoFi stock on platforms like StockTwits. Market participants often rely on real-time information to guide their investment decisions, making it essential to understand how these external factors shape sentiment related to SoFi.

For instance, economic indicators such as employment rates, inflation data, and interest rate changes can significantly influence investor perceptions of SoFi. Positive economic data, like a better-than-expected jobs report, might enhance bullish sentiments in the StockTwits community, leading to increased discussions about SoFi stock. Conversely, adverse conditions, like rising inflation or declining employment metrics, may result in more bearish discussions, creating a sell-off sentiment. These fluctuations can be observed in real-time as traders react to economic events.

Moreover, regulatory changes can directly impact financial institutions, including SoFi. Changes in legislation, such as new lending regulations or modifications in fintech policies, tend to spark heated debates on StockTwits. When favorable regulations are announced, they usually elicit positive sentiment, often reflected by a spike in SoFi stock discussions. On the other hand, restrictive regulations can lead to negative sentiment, with users expressing concerns about compliance risks and the potential impact on SoFi’s growth.

Additionally, advancements in technology play a crucial role in shaping investor discussions. As new fintech solutions emerge or competitors introduce innovative products, sentiments within the StockTwits community regarding SoFi can shift. If SoFi adopts cutting-edge technology or expands its offerings to meet consumer demands, it generally generates positive conversations, attracting more interest to SoFi stock.

In summary, external news events—ranging from economic indicators to regulatory changes and technological advancements—exert a strong influence on discussions about SoFi on platforms like StockTwits. Investors are likely to respond quickly to these developments, reflecting their sentiments through their comments and shares, thereby shaping the collective perspective on SoFi stock.

Future Projections for SoFi Based on StockTwits Sentiment

The analysis of market sentiment surrounding SoFi, as observed through the discussions on StockTwits, plays a significant role in understanding future projections for this financial technology company. Recent trends identified in sentiment analysis reveal mixed opinions from both retail investors and market analysts. Positive sentiment is often reflected in discussions celebrating SoFi’s continued user growth, the expanding range of financial services offered, and strategic partnerships enhancing its market position. Enthusiasts point out the potential for SoFi stock to benefit from the ongoing digitization of banking and wealth management, signifying a bullish outlook for the forthcoming quarters.

Conversely, there exists a portion of the StockTwits community expressing skepticism regarding SoFi’s ability to scale profitably amidst increasing competition within the fintech sector. Concerns include rising interest rates that could adversely affect personal loans and refinancing products, which are critical segments of SoFi’s revenue model. Analysts caution that while sentiment can reflect optimism, it is crucial to consider macroeconomic variables and regulatory challenges which might impact SoFi’s growth trajectory.

Expert opinions compiled from StockTwits discussions suggest that while there is a predominant bullish sentiment based on SoFi’s innovations and market adaptability, potential investors should exercise caution. It is advisable to stay abreast of upcoming earnings reports and market trends as these will provide clearer insights into SoFi’s future stock performance and its reception among investors. In summary, the outlook for SoFi appears cautiously optimistic, influenced heavily by the sentiments expressed through StockTwits, making it essential for stakeholders to continually monitor these discussions for emerging patterns that could signal shifts in future sentiment and stock performance.

Conclusion: The Role of Social Sentiment in Stock Trading

In the complex world of stock trading, the influence of social sentiment has emerged as a pivotal factor in shaping market dynamics. Platforms like StockTwits play a critical role in this landscape, offering investors and traders immediate access to crowd-driven insights and discussions. Specifically regarding SoFi, or Social Finance Inc., the interactions and sentiments expressed on StockTwits represent a valuable resource for gauging market sentiment. As traders assess the potential impact of news, earnings reports, and market trends, the insights relayed on these platforms can expedite decision-making processes.

The SoFi StockTwits community showcases a diverse range of opinions, from bullish predictions to cautious assessments. This variability reflects the broader market sentiment and often correlates with price movements. By monitoring these discussions, investors can identify prevailing trends and sentiment shifts, which could effectively inform their trading strategies. For instance, a surge in positive sentiment towards SoFi might indicate an impending upward trend, while a wave of negative comments could signal potential market corrections.

It is crucial to recognize that while social sentiment can provide significant insights, it should not be the sole basis for trading decisions. The opinions shared on StockTwits can be influenced by various factors, including user biases or misinformation. Therefore, investors should combine insights from platforms like StockTwits with comprehensive analysis and research. Ultimately, the role of social sentiment in stock trading cannot be overstated, particularly as it relates to real-time discussions around SoFi. In conclusion, cultivating a balanced approach that incorporates both community sentiment and fundamental analysis is essential for making informed trading decisions in today’s fast-paced market environment.

You May Also Read This Siliconsift.